Meta’s advertising ecosystem in 2025 looks very different from the one advertisers learned a few years ago.

Privacy changes, reduced targeting options, and aggressive AI-driven optimization have reshaped how audiences are built and how campaigns scale.

In this environment, the debate around broad vs interest targeting on Meta Ads is no longer theoretical. It directly affects cost efficiency, learning stability, and long-term scalability.

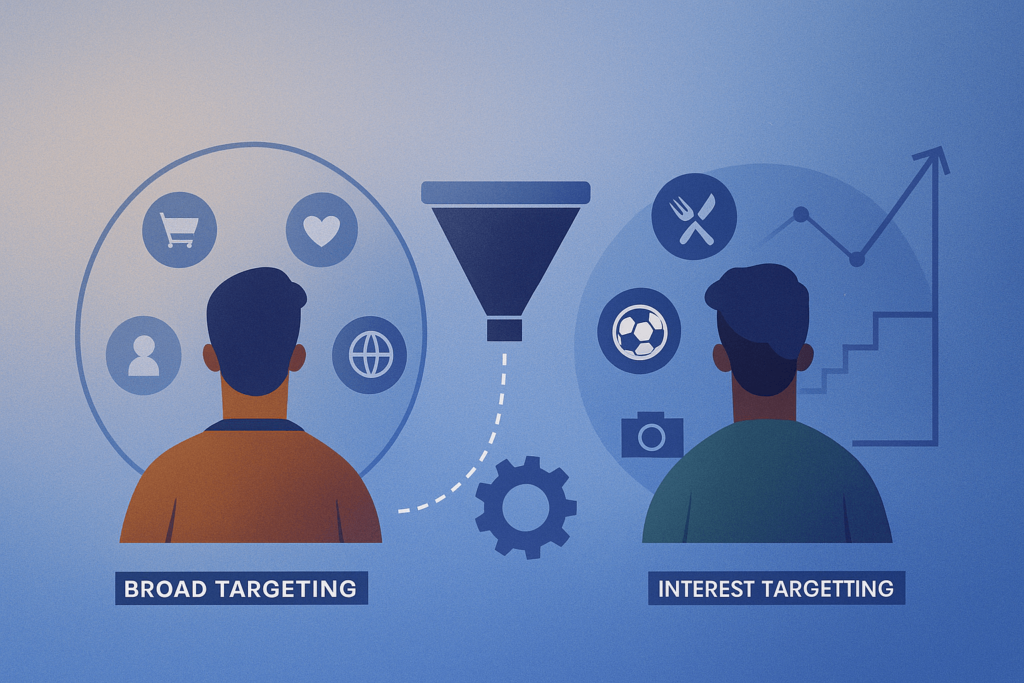

Broad targeting removes most audience constraints and allows Meta’s algorithm to decide who should see your ads based on conversion signals and behavioral data.

Interest targeting, by contrast, still relies on predefined audience signals such as behaviors, demographics, and interests selected by the advertiser.

Both approaches remain viable in 2025, but they win in very different conditions.

Understanding when each approach delivers stronger outcomes requires looking beyond surface-level performance metrics.

The real distinction lies in data maturity, creative strength, budget depth, and how well Meta’s machine-learning system can interpret your signals.

When those variables are misaligned, even a technically correct setup can underperform.

How Meta’s Algorithm Interprets Broad and Interest Targeting in 2025

Meta’s ad delivery system is fundamentally predictive.

Every campaign is an exercise in probability: the algorithm evaluates users based on how likely they are to complete the selected optimization event.

In 2025, this system relies far more on post-click and post-conversion signals than on declared interests alone.

Broad targeting works by removing manual constraints and allowing Meta to explore the widest possible pool of users.

The algorithm then narrows delivery dynamically based on observed behavior.

Meta has repeatedly emphasized that its AI models perform best when given large, unrestricted audiences paired with high-quality conversion data, a stance reiterated in Meta’s official guidance on Advantage+ audience optimization.

Interest targeting, on the other hand, pre-filters the audience before delivery begins.

This can help early-stage campaigns avoid wasting spend, but it also limits the algorithm’s ability to discover non-obvious buyers.

In 2025, interest signals function more like directional hints than hard rules. Meta still evaluates individual users inside those audiences based on predicted conversion likelihood, not interest membership alone.

The practical implication for broad vs interest targeting on Meta Ads is that broad targeting leverages Meta’s full learning capacity, while interest targeting constrains it in exchange for short-term control.

Neither approach is inherently superior; performance depends on whether the account can support Meta’s learning process.

When Broad Targeting Wins: High-Signal, High-Volume Accounts

Broad targeting consistently outperforms interest targeting once an account has accumulated reliable conversion data.

Meta’s own engineering blog explains that machine-learning models improve significantly with higher event volume, particularly for lower-funnel actions like purchases and qualified leads .

Accounts generating at least 50–100 optimized conversion events per week per campaign provide the algorithm with enough signal density to identify patterns across demographics, behaviors, and placements.

In these conditions, broad targeting allows Meta to expand beyond obvious audience segments and uncover users who would never appear in traditional interest buckets.

Creative variety becomes a decisive factor here. With fewer targeting filters, the ad itself must qualify the audience.

Strong hooks, clear positioning, and differentiated creative angles allow Meta to learn faster because engagement and conversion signals are cleaner.

Agencies running large-scale UGC programs have reported improved CPA stability after shifting from layered interests to broad audiences paired with aggressive creative testing, according to case studies published by performance marketing firms like Common Thread Collective.

Budget size also matters. Broad targeting requires enough daily spend to sustain exploration.

Smaller budgets often fail not because broad targeting is ineffective, but because the algorithm never receives enough data to converge.

In these scenarios, interest targeting can appear more efficient simply because it narrows the initial learning space.

In mature accounts with stable tracking, consistent creative output, and sufficient spend, broad vs interest targeting on Meta Ads tilts decisively in favor of broad targeting for scalability and long-term efficiency.

When Interest Targeting Wins: Early-Stage and Low-Data Campaigns

Interest targeting still plays a critical role in 2025, particularly for advertisers without strong historical data.

New ad accounts, new pixels, or newly launched products lack the behavioral signals Meta needs to optimize effectively at scale.

In these cases, broad targeting often results in inflated CPAs during the learning phase.

Interest targeting acts as a temporary scaffold. By narrowing the audience to users with demonstrated relevance, advertisers reduce early waste and help the algorithm find initial conversion clusters faster.

This is especially valuable for niche products, local services, or offers with long consideration cycles.

Meta’s own documentation acknowledges that limited data environments benefit from more guidance, particularly when optimizing for higher-funnel events such as leads or add-to-cart actions.

Interest targeting provides that guidance without completely overriding the algorithm’s predictive process.

Another advantage lies in budget efficiency. Smaller daily budgets often cannot sustain broad exploration.

Interest targeting concentrates spend, producing faster feedback loops and more interpretable results.

This allows advertisers to validate offers, creatives, and messaging before transitioning to broader audiences.

For these reasons, broad vs interest targeting on Meta Ads does not represent a linear progression where one replaces the other. Interest targeting remains a strategic tool for controlled testing and early-stage signal generation.

Creative Quality as the Deciding Factor Between the Two

In 2025, creative quality has become the dominant performance lever on Meta Ads. As targeting options shrink, the ad itself increasingly determines who converts.

This shift disproportionately benefits broad targeting, but only when creative execution is strong.

Meta has publicly stated that creative diversity improves algorithmic learning by exposing ads to different user segments and behavioral contexts.

Broad targeting amplifies this effect because creatives are tested across a wider audience spectrum.

Weak creatives struggle under broad targeting because the algorithm lacks clear engagement signals.

In those cases, interest targeting can artificially inflate performance by filtering for users already predisposed to engage. This often creates a false sense of success that collapses when scaling begins.

Strong creatives reverse that dynamic. Clear problem framing, specific outcomes, and authentic messaging allow Meta’s models to identify high-intent users regardless of declared interests.

This is why advertisers with robust creative pipelines often see better results when transitioning from interest-based audiences to broader setups.

The practical takeaway is that creative maturity should guide decisions around broad vs interest targeting on Meta Ads.

Targeting cannot compensate for weak messaging in a system increasingly optimized around creative-driven signals.

Budget Depth and Learning Stability

Budget depth influences not just scale, but learning stability. Broad targeting requires consistent spend to allow Meta’s algorithm to test, discard, and refine delivery patterns.

Without that consistency, performance fluctuates and optimization resets frequently.

Interest targeting is more forgiving under constrained budgets because it reduces exploration costs.

However, this also caps growth potential. As campaigns scale, interest audiences saturate quickly, leading to rising CPMs and declining efficiency.

Meta’s internal research indicates that campaigns exiting the learning phase successfully tend to maintain steadier performance over time, especially when audience size is large enough to support delivery flexibility.

Broad targeting supports this stability once learning thresholds are met.

This creates a natural progression: interest targeting to stabilize early performance, followed by broad targeting to unlock scale.

Framing broad vs interest targeting on Meta Ads as mutually exclusive misses this lifecycle reality.

Algorithm Trust and Control Tradeoffs

A core tension in Meta advertising is control versus trust. Interest targeting gives advertisers a sense of control by defining who sees ads.

Broad targeting requires trust in Meta’s algorithm to make those decisions autonomously.

In 2025, Meta’s delivery system is demonstrably better at pattern recognition than manual audience selection, provided it receives clean signals.

Advertisers who resist broad targeting often do so because of short-term volatility, not long-term inefficiency.

Interest targeting remains useful when regulatory constraints, brand safety considerations, or compliance requirements demand tighter audience definitions.

In those cases, performance tradeoffs may be acceptable.

Ultimately, the choice between broad vs interest targeting on Meta Ads reflects an advertiser’s tolerance for algorithmic autonomy and their confidence in their data infrastructure.

Transitioning Between Interest and Broad Targeting

Successful advertisers rarely choose one approach permanently. Instead, they transition as accounts mature. Interest targeting builds the initial data foundation; broad targeting scales it.

Running parallel campaigns during this transition provides comparative insight without disrupting performance.

Excluding retargeting audiences from broad campaigns helps preserve clarity in learning and attribution.

Over time, as conversion volume increases and creative systems improve, interest targeting often becomes redundant.

At that stage, broad targeting not only outperforms but simplifies campaign management by reducing audience fragmentation.

How Budget Size Changes the Outcome of Broad vs Interest Targeting on Meta Ads

Budget size quietly determines who wins the debate around broad vs interest targeting on Meta ads, yet it’s one of the most misunderstood variables in campaign performance.

The same targeting setup can look wildly different at $20 per day versus $500 per day, and without accounting for this, advertisers often draw the wrong conclusions.

Broad targeting relies on statistical volume. Meta’s algorithm needs enough impressions, clicks, and conversion attempts to identify meaningful patterns.

When budgets are too small, broad audiences scatter delivery too thinly, causing unstable CPAs and slow learning.

In these cases, interest targeting often appears more efficient—not because it’s fundamentally better, but because it artificially concentrates spend into a smaller audience pool.

This creates faster feedback loops and more predictable short-term results.

This is why many advertisers report that interest targeting “works better” on low budgets. What’s actually happening is controlled exposure.

Interest targeting reduces variance when spend is constrained, making it easier for Meta to generate early conversion signals.

However, this efficiency comes at a cost: limited scalability. As spend increases, interest audiences saturate quickly, CPMs rise, and performance plateaus.

At higher budgets, the balance shifts. Broad targeting benefits from scale, allowing Meta to explore, learn, and optimize across a wider population.

Once spend is high enough to sustain learning cycles, broad audiences often outperform interest-based setups in both stability and long-term efficiency.

This is where the comparison of broad vs interest targeting on Meta ads becomes less about preference and more about budget reality.

In practice, budget should dictate sequencing. Interest targeting can be used to stabilize early spend and validate messaging.

Broad targeting becomes the better option once budget thresholds allow Meta’s learning system to function as intended.

Treating them as interchangeable without accounting for spend is one of the fastest ways to misread performance data.

How Conversion Event Choice Affects Broad vs Interest Targeting Performance

Another decisive factor in broad vs interest targeting on Meta ads is the conversion event you choose to optimize for.

Not all events send the same quality of signal, and the strength of that signal dramatically affects how each targeting model performs.

Broad targeting depends heavily on high-intent, clearly defined conversion events.

When optimized for purchases, qualified leads, or other bottom-funnel actions, Meta’s algorithm can reliably distinguish between low-value interactions and real buying behavior.

This allows broad audiences to self-correct quickly, prioritizing delivery toward users who resemble actual converters.

Problems arise when broad targeting is paired with weak or ambiguous events. Optimizing for page views, content views, or low-intent leads floods the algorithm with noise.

Without a clear distinction between curiosity and intent, Meta struggles to refine delivery within a broad audience.

This is where interest targeting can temporarily outperform broad setups by pre-filtering users who are at least contextually relevant.

Interest targeting acts as a proxy filter when event quality is low. It narrows exposure to users who are more likely to engage meaningfully, even if the conversion signal itself isn’t strong.

This makes interest targeting useful in early funnel campaigns or situations where high-quality conversion data isn’t yet available.

However, once stronger conversion events are introduced, the advantage shifts.

Broad targeting paired with robust events allows Meta to optimize beyond surface-level attributes, identifying behavioral patterns that interest categories can’t capture.

This is why advertisers often see a sudden performance reversal after switching optimization events, even when targeting remains unchanged.

Understanding this relationship prevents a common mistake: blaming targeting when the real issue is event selection.

In the context of broad vs interest targeting on Meta ads, conversion events aren’t just settings—they’re the language the algorithm understands.

Why Account History and Data Age Influence Broad vs Interest Targeting Results

Account history plays a critical but often overlooked role in broad vs interest targeting on Meta ads.

Two advertisers can run identical campaigns with identical budgets and creatives, yet see different outcomes purely because of differences in data maturity.

New or recently reset ad accounts lack historical context.

Meta’s algorithm has limited reference points for predicting who is likely to convert, which makes broad targeting less efficient in the early stages.

Without prior behavioral data, broad audiences behave more like exploratory tests, increasing volatility and extending the learning phase.

In these situations, interest targeting provides structure. It gives the algorithm a starting framework, reducing uncertainty while initial data is collected.

This is why newer accounts often experience more stable early performance with interest-based setups, even though scalability may be limited.

As accounts age and accumulate consistent conversion data, the dynamic changes. Historical patterns allow Meta to make more accurate predictions across broader audiences.

At this stage, broad targeting benefits from compounding data advantages, often outperforming interest targeting in both efficiency and resilience.

Data age also affects how quickly campaigns recover from changes. Mature accounts using broad targeting tend to stabilize faster after creative refreshes, budget adjustments, or campaign restructures.

Interest targeting, by contrast, relies more heavily on manual segmentation and may require frequent adjustments to maintain performance.

This explains why advice around broad vs interest targeting on Meta ads often feels contradictory.

What works exceptionally well for an established account can fail entirely for a new one. Without factoring in account history, comparisons become misleading.

Targeting strategy doesn’t exist in a vacuum. It’s shaped by time, data accumulation, and behavioral signals built over months—not days.

Recognizing this prevents premature conclusions and helps align targeting choices with where an account actually is in its lifecycle.

Conclusion

In 2025, the debate around broad vs interest targeting on Meta Ads is no longer about which method is “better.” It is about timing, data readiness, and operational maturity.

Broad targeting excels when supported by strong signals, creative depth, and sufficient budget. Interest targeting wins when control, efficiency, and early-stage learning matter more than scale.

Advertisers who understand these dynamics stop treating targeting as a static choice and start using it as a strategic lever.

The result is not just better performance, but a system that evolves alongside Meta’s increasingly AI-driven ecosystem.