Digital advertising in 2025 is no longer about simply driving clicks and impressions.

Finance leaders, marketing executives, and growth managers want evidence that campaigns not only attract customers but also generate sustainable profit.

That is where the discussion of ROAS vs POAS becomes critical. Both metrics evaluate advertising efficiency, but they approach the question from two different angles.

Return on Ad Spend (ROAS) has been the industry standard for years. It tells you how much revenue is generated for every unit of currency invested in ads.

On the surface, this number looks like the ultimate scorecard for success. However, it often fails to capture whether the revenue being measured actually translates into profit.

This gap is where Profit on Ad Spend (POAS) enters the conversation. Unlike ROAS, which stops at revenue, POAS accounts for costs beyond ad spend, offering a clearer picture of profitability.

The rise of performance-driven marketing and tighter budget oversight has made this comparison unavoidable.

Why Finance Teams Push for POAS Over ROAS

For years, marketing teams have leaned heavily on ROAS as the go-to performance metric. It’s clean, easy to calculate, and gives an immediate sense of revenue impact relative to ad spend.

But in 2025, finance leaders are increasingly skeptical of campaigns judged only on ROAS. The reason is simple: revenue alone doesn’t determine business health.

You can have campaigns with strong ROAS that still drain profit because they ignore factors like product cost, fulfillment fees, or discounts.

This is where POAS becomes invaluable. Unlike ROAS, which focuses on top-line results, POAS looks directly at profit.

Profit-focused analysis ensures that every advertising dollar is judged not just on how much money it brings in, but on how much actual margin it leaves behind after costs.

For industries with razor-thin margins—think fashion, consumer electronics, or grocery—POAS often paints a more realistic picture than ROAS.

Finance departments prefer POAS because it aligns advertising data with overall company profitability targets.

Instead of rewarding campaigns that drive sales volume at the expense of margins, POAS highlights campaigns that truly add to net income.

This is especially crucial in environments where customer acquisition costs are rising year after year.

By focusing on POAS, teams can avoid scaling campaigns that look impressive on the surface but fail to sustain the business long term.

The shift from ROAS to POAS also changes how budgets are allocated.

A campaign with a 5x ROAS might get attention quickly, but if its POAS drops below break-even due to high fulfillment or heavy discounting, finance will pull back investment.

On the other hand, a campaign with a modest 2x ROAS could actually be more valuable if its POAS proves positive and consistent.

This distinction is why companies moving toward profit-driven decision-making lean heavily on POAS as their primary metric.

Ultimately, finance teams want clarity. ROAS vs POAS is not just a marketing debate—it’s about creating accountability across departments.

While ROAS is still useful for quick health checks, POAS offers a financial truth that ensures growth is sustainable and that scaling efforts don’t erode profit margins over time

Defining ROAS and POAS in Clear Terms

Before comparing their strengths, it’s important to define exactly what ROAS and POAS measure.

These two metrics are closely related but serve very different purposes in evaluating advertising campaigns.

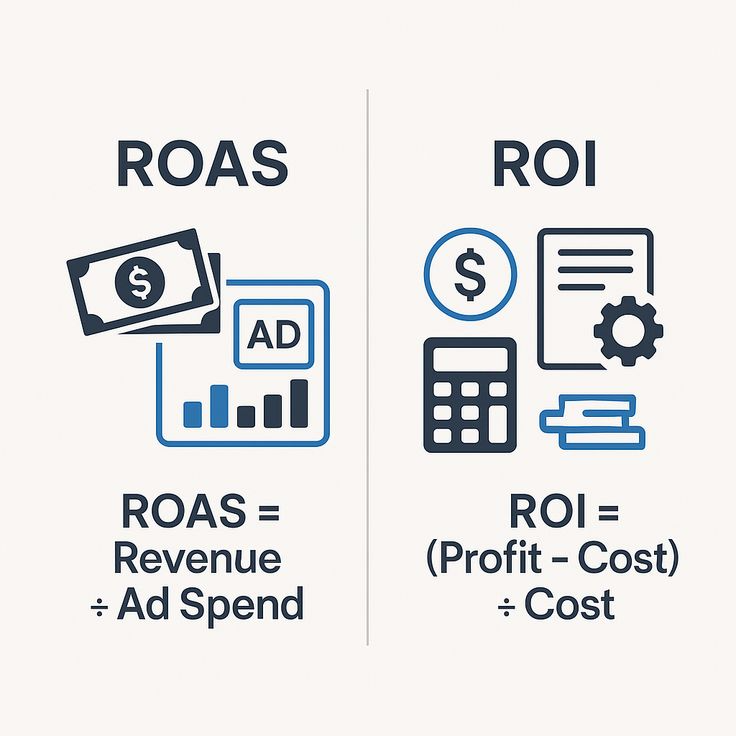

Return on Ad Spend (ROAS) is calculated as revenue generated from ads divided by the total ad spend. The formula looks like this:

ROAS = Revenue from Ads/Advertising Spend

For example, if a campaign generates $10,000 in revenue from $2,000 in ad spend, the ROAS would be 5.

This means the business earned five dollars in revenue for every dollar spent on advertising. Marketers love ROAS because it is easy to calculate and compare across campaigns.

It provides a quick benchmark for efficiency and is especially useful in the early stages of testing.

However, ROAS only looks at revenue. It does not factor in product costs, logistics, payment processing fees, or other operational expenses.

This can lead to misleading insights. A campaign might show a strong ROAS but still result in negative profit once all costs are considered.

Profit on Ad Spend (POAS) addresses this blind spot by shifting the focus from revenue to profit. The formula is:

POAS = Profit from Ads/Advertising Spend

Using the earlier example, if the $10,000 in revenue produced only $2,500 in profit after subtracting costs, and the ad spend was $2,000, then the POAS would be 1.25.

This shows that while the campaign had a 5x ROAS, it only delivered a modest return on profit.

The key difference is that ROAS highlights growth potential while POAS highlights sustainability.

Businesses that rely solely on ROAS may end up scaling campaigns that boost revenue but erode margins.

By contrast, tracking POAS ensures that scaling decisions are grounded in profitability, not just sales volume.

Understanding these definitions makes it easier to see why the ROAS vs POAS debate is so relevant in today’s competitive advertising landscape.

As acquisition costs rise and margins tighten, companies can’t afford to ignore profitability when evaluating performance.

Why ROAS Alone Can Be Misleading

At first glance, ROAS seems like the ultimate golden metric. It’s quick, clean, and easy to understand: for every dollar you put into advertising, here’s how much revenue you got back.

That simplicity is why so many e-commerce brands obsess over it, especially when reporting results to investors, stakeholders, or even internal teams.

A high ROAS looks impressive and signals efficiency. But the problem is that it doesn’t tell the full story, and in e-commerce, ignoring the hidden numbers can quietly eat away your profits.

Let’s paint a scenario. Suppose you run a campaign where you spend $10,000 on Facebook Ads and generate $40,000 in revenue.

On paper, that’s a 4x ROAS. You’d likely feel confident scaling this campaign, showing it off as a success.

But if you dig deeper into your expenses, you might discover that your cost of goods sold is $20,000, shipping and logistics take another $8,000, and customer support adds $5,000.

Suddenly, your “amazing” 4x ROAS leaves you with just $7,000 in profit, which barely justifies the time, energy, and risk of running the campaign.

This is the trap many advertisers fall into when focusing only on ROAS. It doesn’t account for variables like product margins, fulfillment costs, return rates, or overhead expenses.

That means you could be scaling campaigns that look fantastic in theory but are draining your cash flow in reality.

In other words, revenue is vanity — and without context, ROAS risks becoming a vanity metric.

Why POAS Gives a More Accurate Profit Picture

This is where POAS — Profit on Ad Spend — comes in as a far more reliable truth-teller.

Instead of just tracking the revenue your ads generate, POAS takes the next step and calculates how much profit is left after all costs are deducted.

In e-commerce, where every dollar counts and margins can be razor-thin, this makes POAS a game-changer.

Think of POAS as the “profit compass.” If ROAS shows you the direction you’re heading, POAS shows whether that direction actually makes financial sense.

For example, if you spend $5,000 on ads and generate $15,000 in revenue, you might celebrate a 3x ROAS.

But after subtracting $7,000 in product costs, $2,000 in shipping, and $1,000 in platform fees, you’re left with $5,000 in profit.

That means your POAS is 1x — not terrible, but not exactly scalable either.

Brands that adopt POAS as their guiding metric tend to make smarter decisions. Instead of chasing revenue highs, they focus on campaigns that leave real money in the bank.

This ensures sustainable growth, especially in competitive e-commerce niches where overspending on “flashy” campaigns can quickly lead to burnout.

In short, POAS tells you the truth about whether your ad dollars are truly working for you.

It’s not about how loud the revenue number looks on reports, but about how much cash you’re actually able to reinvest in inventory, operations, or scaling.

How to Decide Which Metric Matters for Your Store

So, when it comes to ROAS vs POAS, which one should you prioritize? The answer isn’t as black and white as you might think.

Both metrics provide valuable insights, but they serve different purposes depending on your business model, goals, and stage of growth.

For instance, if you sell high-margin products like digital goods, software, or luxury items, ROAS can be enough to measure efficiency because your costs are minimal.

In these cases, revenue aligns closely with profit, and tracking POAS won’t always add significant insight.

On the other hand, if you’re in a product-heavy business — think apparel, electronics, or consumer goods — costs like manufacturing, shipping, returns, and customer service can quickly erode revenue.

Here, POAS is essential because it ensures you’re scaling only what actually makes money.

Another factor is your growth stage. Startups often look at ROAS to understand quick wins and validate campaigns.

Mature businesses with larger ad budgets tend to prefer POAS because it shows true profitability across channels.

Smart brands, however, use both. ROAS becomes the “health check,” offering a quick read on ad efficiency, while POAS is the “profit gauge,” driving strategic decisions on scaling and budget allocation.

Ultimately, the right metric depends on whether you care more about looking profitable or actually being profitable.

The smartest e-commerce brands know that while ROAS can help keep campaigns on track, POAS should lead the way when it comes to long-term business growth.

Mistakes Brands Make When Tracking These Metrics

Even with the right tools at hand, many e-commerce brands still mismanage how they use ROAS and POAS.

These mistakes often result in wasted budgets, misinformed decisions, and poor scaling strategies. Recognizing the common pitfalls is the first step toward building smarter campaigns.

One of the biggest mistakes is relying only on ROAS. This often creates a false sense of security.

A campaign showing a 5x ROAS might look unbeatable, but if hidden costs eat into margins, you may actually be operating at a loss.

Another mistake is not including all costs when calculating POAS. Some brands only subtract product costs, forgetting about overheads like software subscriptions, payment fees, or returns.

This incomplete calculation creates a distorted picture of profitability.

Another common pitfall is averaging metrics across campaigns. Let’s say your store has three campaigns running: one extremely profitable, one breaking even, and one losing money.

If you average their performance, it might look like your ROAS or POAS is stable, but in reality, the losing campaign is quietly draining your profits.

Brands that don’t segment data properly risk letting underperforming campaigns hide behind the winners.

Lastly, there’s the issue of short-term obsession. Many advertisers panic when they see ROAS or POAS drop for a few days and make knee-jerk budget cuts.

But e-commerce is influenced by seasonality, promotions, and consumer trends. Looking at metrics in isolation over short time frames can lead to costly missteps.

Avoiding these mistakes isn’t about perfection — it’s about discipline. By being thorough, consistent, and realistic about costs, brands can use ROAS and POAS as the powerful metrics they were meant to be.

Tools and Strategies for Measuring ROAS and POAS

The good news is that measuring ROAS vs POAS doesn’t have to feel like juggling spreadsheets at midnight.

With the right tools and strategies, you can simplify the process and get accurate insights in real-time.

For starters, Google Analytics 4 (GA4) is a solid foundation. It helps track revenue attribution, customer journeys, and campaign performance across channels.

However, it mostly focuses on revenue, so you’ll need customization or integrations to account for costs.

Meta Ads Manager also tracks ROAS natively, but again, it requires adjustments if you want to factor in profitability.

If you want a more complete view, specialized e-commerce tools like Triple Whale, Northbeam, or Segmetrics are designed to calculate POAS by pulling in not just revenue but also costs of goods, shipping, and overhead.

These tools integrate with your store and ad platforms to show true profit attribution, making them invaluable for scaling profitably.

Beyond tools, strategies also matter. Align your campaigns with product margins.

Low-margin products should only be pushed if they lead to repeat purchases or lifetime value, while high-margin products should be scaled aggressively once POAS is proven.

Also, use cohort analysis to see how new customers perform over time — sometimes a low initial POAS can pay off if customers reorder later.

By combining the right tools with smart strategies, you’ll stop guessing whether your ads are profitable and start knowing. And in e-commerce, clarity is everything.

Scaling Your Ad Strategy With the Right Metric

Scaling is the dream of every e-commerce business — turning winning campaigns into consistent revenue streams.

But scaling without the right metric is like hitting the gas in a car without checking if there’s fuel in the tank.

This is why deciding between ROAS vs POAS becomes critical at the scaling stage. If you scale campaigns based on ROAS alone, you risk amplifying vanity numbers.

Imagine scaling a campaign that shows 6x ROAS, only to discover later that thin margins and rising logistics costs make it unprofitable.

That’s how brands grow themselves into financial trouble. By contrast, scaling based on POAS ensures that every dollar you spend is returning actual profit, not just revenue.

One powerful way to balance both metrics is to treat ROAS like a speedometer — it quickly shows how fast and efficient a campaign is running.

Then, treat POAS like the engine diagnostic — it tells you if the underlying system is truly healthy and sustainable.

Smart scaling happens when both metrics work in harmony.

For example, use ROAS to identify quick wins and promising campaigns. Then, double-check with POAS before deciding which campaigns to scale aggressively.

This dual approach prevents you from falling into the trap of chasing revenue while silently losing money.

In the end, scaling isn’t about going faster — it’s about going further. And only by prioritizing profitability through POAS can you ensure your growth is sustainable.

Conclusion

When all is said and done, e-commerce isn’t a game of who can flash the highest revenue numbers.

It’s a business of margins, sustainability, and profit. ROAS may give you a quick feel-good number, but POAS is the metric that reveals whether your store is built for long-term survival.

This doesn’t mean ROAS is useless — far from it. It’s still a valuable benchmark for comparing campaign efficiency and understanding channel performance.

But if you’re making serious budget decisions, planning your growth trajectory, or trying to build a business that lasts, POAS should be your north star.

The smartest e-commerce brands of 2025 and beyond already understand this. They use ROAS to keep their campaigns sharp but let POAS drive the scaling strategy.

They know that while revenue impresses outsiders, profit is what keeps the lights on.

So, when it comes to ROAS vs POAS, the conclusion is simple: track both, but let POAS lead the way.

Because in a world where ad costs are rising and competition is fierce, profit isn’t just the end goal — it’s the only goal that matters.